Golden Jupiter Capital Management LLP is the Investment Manager of Jupiter Alternative Investment Fund I, which is an investment scheme of Jove Trust, a SEBI registered Category 3 Alternative Investment fund.

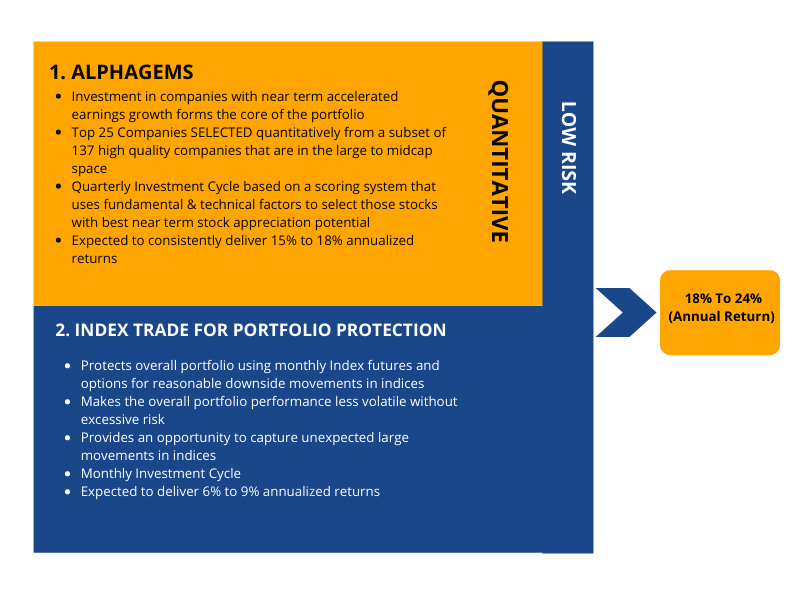

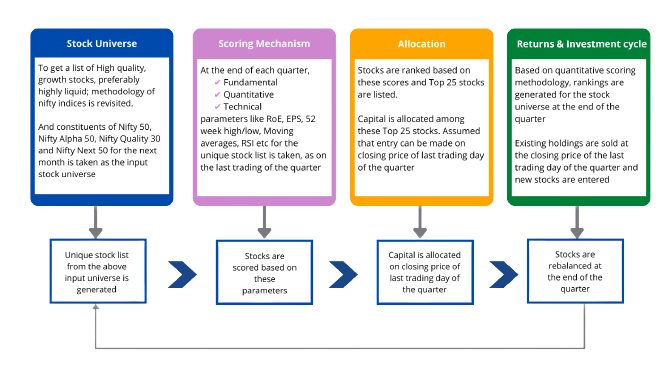

Jupiter AIF invests into equities and equity-related securities using a quantitative selection process constructed by the Investment Manager. This selection process involves creating investment model by ranking and scoring equities and equity related securities based on various factors such as volatility, momentum, mean-reversion, fundamentals and market sentiment/momentum (Alphagems).

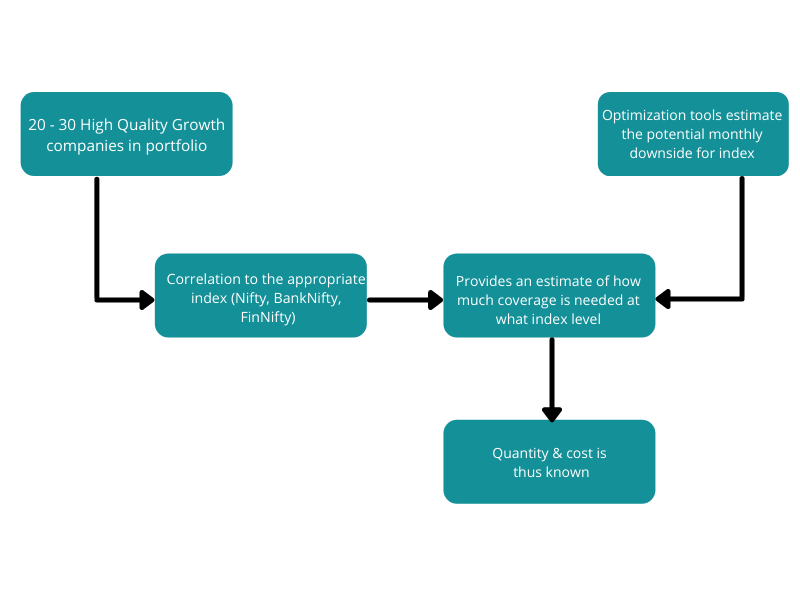

The universe of equities includes already listed companies in leading Equity Indices like Nifty 50, Nifty Next 50, and Nifty Quality 30. Further, the Investment Manager uses a proprietary software technology to find the optimal combination of Index derivatives for portfolio protection (Index Trades) for a particular time period to maximize the potential profit, while managing the risk associated with these positions within a certain risk level. Alphagems and Index Trades together form the Fund’s “Investment Model”.